One Year Since the Coronavirus Crash: Where to Go From Here

A few weeks ago, on March 23, we marked one year since the market bottomed. We learned several essential lessons since March 23, 2020, as investors- both psychologically and fundamentally.

In this edition, we will break down several of the most important lessons we learned and where we can go from here. While we are not out of the clear yet and have other market headwinds to compete with, many of these lessons we learned can be extremely helpful in navigating the rest of 2021 and beyond.

Markets Always Look Forward

Over a year ago, it was hard to anticipate that the government's economic response would be so strong and the public health response would be so weak. However, the market's behavior at that time indicated that it was looking 6-12 months down the road.

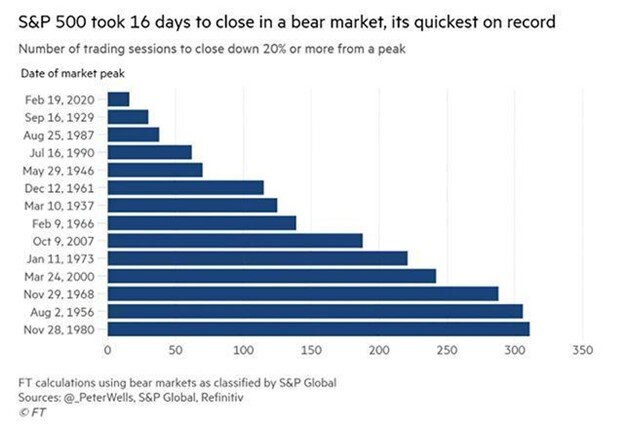

Compare the bear market of 2020 to other previous bear markets. On February 19, 2020, before the market began its painful downturn, the COVID update on CNN read as follows: "the novel coronavirus has now killed more than 2000 people, all but five of them in mainland China. It has infected more than 75000 people.

If the market only concerned itself with the present, it would not have started a rapid descent. However, it understood that COVID's economic and societal impact would be unlike anything we'd ever seen before. It looked forward, and as a result, we saw the fastest bear market in history.

(Source: Marketwatch)

Things looked a lot more dreary on March 23, 2020 than on February 19, 2020. In the week of March 23, 2020, the WHO director-general warned of the "pandemic accelerating" with more than 350,000 cases worldwide. The U.S. also had just bumped past China and Italy as the world's leader in COVID-19 infections.

You would think that based on these grim milestones that the market would've crashed more based on the conditions on the ground at that time.

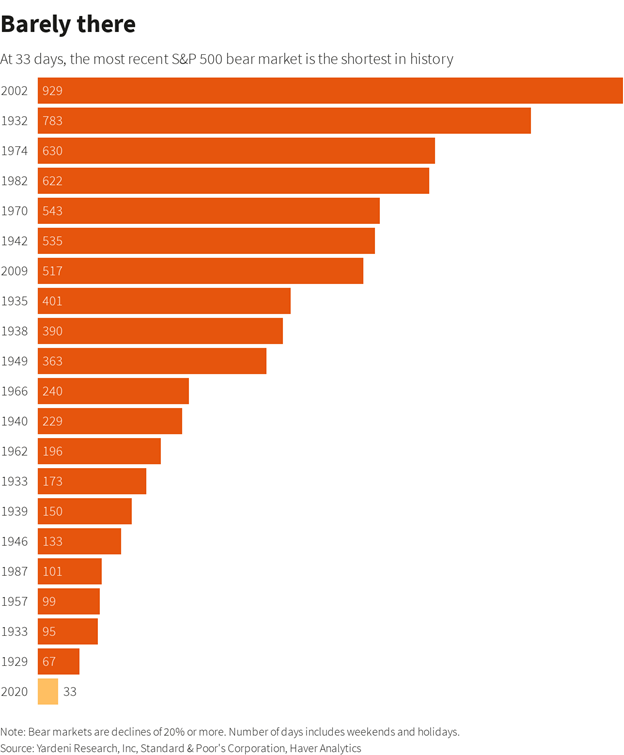

However, that wasn't the case. The market foresaw the potential for an unprecedented economic rebound. Interest rates were at zero, and central banks worldwide were injecting historic amounts of capital to keep economies afloat. The bear market officially ended after 33 days, suitable for the shortest bear market in history.

(Source: Reuters)

Since March 23, 2020, the S&P 500 has almost doubled and exceeded the 4100-level for the first time.

(Source: StockCharts)

If the market did not anticipate dovish monetary policies, unprecedented aid and stimulus, and eventual vaccines, it's simple- the bottom would have been limitless. The pandemic is still not over. However, you can arguably say that the market saw the light at the end of the tunnel before anyone else did.

Nobody knows "where" the actual bottom is for stocks during a bear market. But in the long-term, markets move higher and focus on the future rather than the past or present.

Never Try and Time the Market

Trying to time the market is a cardinal sin, especially as the Bill Ackman's of the world want to scare you into thinking that "hell is coming" (and profit about $2 billion off your fear in the process).

Many investors over a year ago didn't stick it out through the volatility and lost out. Many others panic sold before the market even bottomed, and never bought back in.

When you try and time the market, you miss out on generational opportunities. If you panic and try and time the market, you no longer follow your principles. "Buy low and sell high" becomes null and void, and you become so obsessed with timing and psychology that you may even outsmart yourself.

"Because of the severity and swiftness of the selloff, a lot of investors sold on the way down or at the bottom" – which was technically on March 23, 2020 – "and never bought back in after the lows," former hedge fund manager and co-founder of DataTrek Nicholas Colas said. "Sounds cliche, but I have had many, many conversations with people who panicked, missed the first 50% move back up, and are still underinvested today."

"Not rookies either," he added. "If you didn't live through 2008, 2020 looked like the world was coming to an end."

Never Trade With Emotions

This concept expands on the previous point of never trying to time the markets. When you trade with emotion, either with euphoria or fear, you lose your sense of balance, you forget your principles, and you lose out.

When the market did what it did a year ago, those who succeeded played volatility to their advantage and remained cautious but not scared and bold without being reckless.

The best thing to do is to understand behavioral finance just as much as fundamentals. In the last year, behavioral finance, or the study of how psychology can affect investors' or analysts' behavior, took on newfound importance. Just because investors are not always rational and can be easily swayed by their own biases does not mean you have to be.

Brett Horowitz, a wealth manager at Evensky & Katz in Florida, said that the crisis illustrated his role beyond just an advisor. He said that part of his duties over the past 12 months involved "slapping clients' hands away from the "sell" button."

As seen below, Sherman Wealth put together an informative chart depicting the emotional rollercoaster that investors can go through and how it may affect investment decisions.

(Source: Sherman Wealth)

Reflecting this chart, a study by H. Kent Baker and Victor Ricciardi looked at how eight different behavioral biases can impact investment decisions:

Anchoring or Confirmation Bias: It's easy to have preconceived notions, and investing is no exception. It's easy for an investor's judgment to be clouded based on what they already know or think they know. "An investor whose thinking is subject to confirmation bias would be more likely to look for information that supports his or her original idea about an investment rather than seek out information that contradicts it," as quoted by Sherman Wealth.

Regret Aversion Bias: This is also commonly known as loss aversion and describes how investors often make decisions based on avoiding the feeling of regret after making a poor choice. Investors influenced by anticipated regret usually take less risk and are reluctant to make moves.

Disposition Effect Bias: The tendency to label investments as winners or losers. This bias can cause investors to hold onto investments that have peaked or sell a winning investment too early to make up for previous losses.

Hindsight Bias: When investors believe in hindsight that a past event was predictable and obvious when in reality, that's not usually the case.

Familiarity Bias: Familiarity bias occurs when investors prefer familiar or well-known names despite diversification benefits (which we will discuss later).

Self-attribution Bias: Self-attribution bias happens when investors take all the credit for successful outcomes and none of the blame for negative outcomes. Adverse outcomes are never their fault and occur thanks to external factors.

Trend-chasing Bias: Historical returns do not always predict future investment performances. Following trends or the herd rarely works in your favor as an investor too. If you chase trends, you also run the risk of buying high at over stretched valuations.

Worry: Worrying is a natural human emotion; however, it's best to limit it when investing. If you invest with paranoia and anxiety, you run the risk of panic selling and overlooking opportunities. It's wise to trade cautiously but never anxiously.

Because of these behavioral biases, wealth managers often have to moonlight as therapists and psychologists for their clients. Never was that more evident in the last year. "I can think of many clients that wanted to bail out several times over the past year based on concerns of Covid, resurgence of Covid, the elections, the Georgia Senate races, and now the common worry that the stock market is too high and needs to drop," Horowitz said.

"Not only did those clients who bail out lose out on possibly hundreds of thousands of dollars, but the more the market goes up, the more they want to wait so as not to compound the problem of selling low and then buying high," Horowitz added.

You can fearfully sit out and wait for the perfect time to buy all you want. But if you bought even before the market bottomed and are still holding, you'd still have robust returns.

Every Crisis Ends the Same Way

"Markets implode, sending a signal to policy makers. Policy makers respond. The size of the response informs the size of the market bounce-back," former hedge fund manager and co-founder of DataTrek Nicholas Colas said.

Colas has seen everything from the 1990 Iraq invasion of Kuwait to 9/11 to the Financial Crisis. While not every crisis is a carbon copy of each other, and it is a mistake to think so, you have to find a balance. Crises are not uniform- but each one has a similar result and solution. Unless you understand this, you will never spot opportunities to buy low.

A good way of depicting this is by comparing the average length, return, and commonalities of bull markets and bear markets.

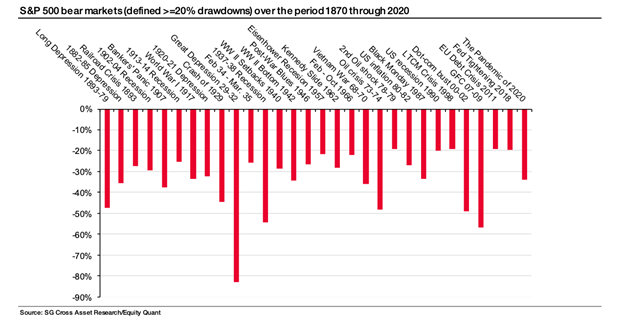

First, though, let's look at the history of bear markets from 1870. In this chart, you can see the various crises that we've gone through in the U.S. We may be the world's greatest superpower. However, it has not always been smooth sailing.

(Source: Heisenberg Report)

Consider this too.

According to Hartford Funds, "the average length of a bear market is 289 days or about 9.6 months. That's significantly shorter than the average length of a bull market, which is 973 days or 2.7 years."

On average, stocks also lose roughly 36% during bear markets and gain approximately 112% during bull markets.

Furthermore, a Goldman Sachs report showed that bear markets triggered by adverse events, such as COVID-19, have lasted shorter and showed quicker recoveries on average than bear markets caused by cyclical movements or structural problems.

Event-driven bear markets also showed more minor declines. On average, event-driven bear markets declined by 29%, compared to an average 31% decline for cyclical bear markets and an average 57% drop for structurally caused bear markets.

(Source: Statista)

Echoing Nicholas Colas’s thoughts on the common denominators between all of these bear markets, and how we’ve gotten out of them, Neil Dutta of Renaissance Macro expanded, saying that “The U.S. has enormous fiscal capacity...The economy is resilient, and the consensus is chronically fighting the last war leading it to underestimate the speed of recovery.”

Not every crisis is the same. But in many ways, they are. Many doubted Warren Buffet and David Tepper in 2008 when they bought up all bank stocks in the midst of the financial crisis. However, looking back, they were entering the longest bull market in history at a discount.

As Buffet says, “never bet against America.”

Key Takeaways: Rebalancing and Diversification to Hedge Against Inflation

Over a year later, the light at the end of the tunnel looks brighter and brighter thanks to an accelerating vaccine roll-out and rebounding economy.

However, now is the opportune time to rebalance and look for inflation hedges, portfolio diversification, low volatility investments, and passive income opportunities.

First and foremost, you have to account for the acceleration of bond yields. Bond yields, while still historically low and stable as of late, have significantly accelerated year-to-date. The 10-year yield started in 2021 below 1%. Now, it's hovering around 1.6%. While this is down from its 14-month peak of roughly 1.75%, the acceleration in its yield is still something to note.

We have seen tech shares plummet almost everytime bond yields have risen. The Nasdaq has entered correction territory twice in 2021 thus far. With $1.9 trillion in stimulus, another $2 trillion spending bill for infrastructure in the equation, and a Fed that's shown no indications that it will turn hawkish and raise rates despite an economy heating up, bond yields could pop further in the future.

On the one hand, bond yields rising at this speed indicate confidence in the economic recovery. On the other hand, rising bond yields can flash warning signs for borrowing costs and potential earnings. Surging yields are especially concerning for high-growth tech companies that often rely on outside financing. It's no coincidence that the Nasdaq has lagged behind the Dow and S&P year-to-date and arguably has more question marks in the near term.

Rising bond yields also are concerning for inflation prospects. While recent inflation data through the consumer price index came in tamer than expected, inflation appears to be all but a certainty over the long term. There is too much government spending coupled with a dovish Fed for inflation not to happen. According to MarketWatch, we could be approaching the "biggest inflation scare in 40 years."

Already, we see signs. Global food prices, for example, rose for the 10th straight month and are at their highest levels since 2014. Gas prices had also surged by almost 25% from this point last year. Commodity prices are also skyrocketing.

Plus, if you look at the U.S. five-year breakeven inflation rate, a market indicator of inflation prospects, it's currently sitting at around 2.52%, nearly its highest level in a decade.

Yes, the $2 trillion infrastructure plan is essential to repair America's crumbling infrastructure. Yet, it's still significant government spending that should buoy inflation prospects. Not only that but all signs point towards the bill's funding through hiking corporate taxes. Tax hikes could also significantly adversely affect the bottom lines of high growth stocks that benefited from President Trump's 2017 tax cuts. Although President Biden has shown a willingness to negotiate his proposal to hike the corporate tax rate to 28%, this is another headwind for high growth stocks.

With analysts such as Deutsche Bank's chief U.S. equity strategist Binky Chadha also calling for a market pullback between 6% and 10% by the end of this quarter, it's essential to use the lessons we learned over the last year and be prepared.

Rebalancing and diversifying is the best way to do that.

We have seen significant volatility every month in 2021 thus far, and market rotations can be intimidating. But suppose you look for ways to protect yourself against warning signs through passive income opportunities that can hedge against inflation. In that case, it's not as complex as you think.

One of the best ways to do that is through increasing exposure to alternative investments.

Traditional investments are stocks and bonds. Alternative investments are an umbrella return referring to any investment in an asset class excluding stocks, bonds, and cash. It can include tangible assets such as precious metals or financial assets such as real estate, infrastructure, commodities, private equity, hedge funds, derivatives, cryptocurrencies, and more.

Alternative investments have evolved over the last 25 years. What once represented just 5% of global pension portfolios in 1996 skyrocketed to more than 25% by 2019.

(Source: Blackrock)

Alternatives tend to behave differently than traditional investments and are a wise way to add diversification, enhance returns, increase income levels, and hedge against macro-level risks such as inflation, economic cycles, or in 2020’s case, a pandemic.

One of the alternative investment vehicles to consider is Farmland Investing.

Why Farmland Investing?

Real estate has traditionally been a great inflation-hedge. That's especially true today. Interest rates are low, the world is reopening, and there is booming demand.

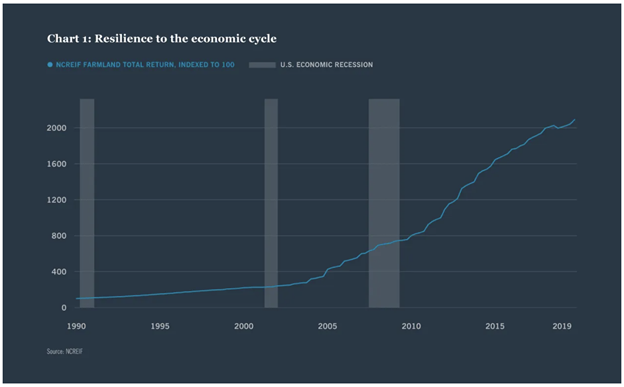

However, Farmland might be the world's most promising untapped asset class and has quietly performed very strongly and stably over the last 50 years, regardless of economic cycles.

In fact, according to Forbes, farmland returns in the U.S. have averaged over 10% for the last 47 years.

Between 1992-2016, farmland assets also averaged an annualized 12% average return and outperformed real estate and the Russell 3000. Over the past two decades, Farmland has also shown to have remarkable resiliency and the ability to preserve capital in times of economic decline.

Our demographics are aging, and Farmland is increasingly changing hands to younger owners looking to sell. There are also decreasing barriers to entry, new buyers, and a growing scarcity of high-quality land due to climate change. No wonder why Bill Gates is one of the largest private owners of farmland in the US.

The chance to get into Farmland may be a generational opportunity.

The next time you see the market sell-off thanks to popping bond yields, or the next time you see an indicator that inflation is right around the corner, think about Farmland.

Not only could this be an excellent way for you to generate passive income. But, it could also be the best possible inflation-hedge to navigate an optimistic yet uncertain time.

Now is the time to practice the lessons you've learned in the year since March 23, 2020. Think of Farmland as an excellent way to do that.