Week in Review - August 24, 2020

60 Second Market Review

What Happened?

● The Fastest Bear Market is over. Has your portfolio recovered too?

● Home Buyers have gone on shopping sprees this year. But is it a good time to buy a home?

Things to be aware of…

● Apple hits $2 trillion, a remarkable (and unfathomable) number.

● Even Buffett is diversifying his portfolio. You should too.

We are here to help:

● Want to double your wealth? Forbes says those with a plan have double than those without. Get your financial plan today.

The Details

What Happened?

Fastest. Bear. Market. Ever.

It only took a few months, but if you were an investor in 2020, you did it. You survived the fastest bear market in history. Hopefully, you didn’t take February and March as an indication that you should never be in stocks, and either got into the market, or stayed invested through it.

If you did not, you might want to reach out to us to make sure you have some proper investment management in place. We can help guide you through these times and secure your financial future.

In the numbers, it was extremely impressive and abnormal to see. The stock market crashed back in the spring, losing 35% from the highs for the fastest 30+% plunge in history. Then in a remarkable comeback, the market has rallied 55% from the March 23 lows, to end the bear market (as defined as capturing new highs).

In short, at our company we profess being properly diversified, as well as staying invested long term. Don't be a trader or a speculator and get caught making massive money mistakes like some likely did this year. Be patient, keep your eyes on your financial goals, and shut out the noise.

Time to buy a house?

Source: Tradingeconomics

Apparently, ultra-low mortgage rates as well as fiscal and monetary support from the Federal Reserve and the government has helped consumers do what they see as the American Dream: Buy a home. Existing Home Sales data is often seen as a barometer for how the economy is doing, so apparently everything is fine.

Despite tens of millions still unemployed, and a global pandemic, people still want to buy homes. July showed a 25% increase in sales over June and hit the highest level since December 2006. Not bad. However, you don't have to buy a home to be successful financially.

Many astute investors are opting to rent, and invest instead (see: Elon Musk). Want to know how the trade offs work? Shoot us an email, and if we get enough asking, we may just do some analysis in next week's piece.

Things to be aware of…

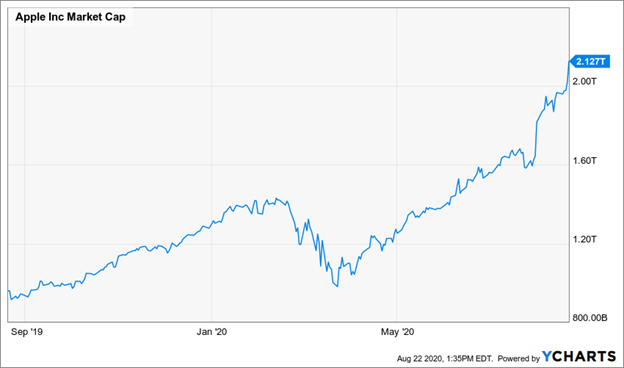

Apple hits $2 Trillion

Apple became the first company to be worth $2 trillion dollars. That is historic. While it might not be everyone's favorite company, it is mostly everyone's. More impressively, the company has added $1 trillion in just 21 weeks. It took 42 years to reach the first trillion.

$2,000,000,000,000 in case you were wondering, is a lot of zeroes. If this seems just a little out of this world, it is because it is. But don't be sad you missed it – because if you own any sort of passive exchange traded fund, you likely own the stock. Want to know if you do? Reach out to us for a free consultation.

Buffett Buys Gold?

Here’s something I didn’t think we'd see in our lifetimes. Warren Buffett's company, Berkshire Hathaway, took a position in Barrick Gold in the second quarter, buying 21 million shares worth roughly $564 million. What did the stock do when he announced that? Jumped 12%. Must be nice.

The reason this is so shocking is that Buffett has been an outspoken critic of gold in the past, calling it a "cube that doesn't do anything." So to see him add a position in a company that mines worthless cubes was either admitting he was wrong, or taking advantage of some diversification benefits.

Buffett has always used a baseball analogy when investing. He says that investing is like baseball, but with no three strike out rule. "The trick in investing is just to sit there and watch pitch after pitch go by and wait for the right one in your sweet spot. And if people are yelling, 'Swing, you bum!,' ignore them."

We agree. And diversification is something to help you hit your investments out of the park, every time, over time. Let us show you the way.

Want to learn more? Reach out to us. Want to help us? Share this with your friends and family.